Tidbits, Basis Decision, Corn Outlook, ENSO, Export Inspections, Markets & Rain Days Update 8/8/23

- Wright Team

- Aug 8, 2023

- 4 min read

Basis Decision

The cash price paid to farmers is a function of futures and basis. You need to separate the day you price them because the basis is usually weak when futures are strong and basis is strong when the futures are weak. It does not matter which one you price first. If you must deliver corn and/or beans at harvest, you need to set the basis this week for at least half of your fall delivery bushels if you think the basis at the peak ten days of harvest will be weaker than the current bid for fall delivery basis. Some of you are dragging your feet on making the fall basis decision even though you agree the basis will be weaker this fall. Monday was probably the low day for corn and bean futures before harvest and very well maybe the low for the rest of 2023. The weather cannot get any better for soybeans in August. Last evening’s 8 to 14 day forecast reduced the percentage of the soybean area that is expected to cool & wet: https://www.cpc.ncep.noaa.gov/products/predictions/814day/index.php Set some fall delivery basis now. If futures do not go to the moon before harvest, deliver the bushels, get your cash advance and wait for the futures to rally into 2024. If you are unsure of what to do and why, read last Wednesday’s and Thursday’s reports.

Highlights

Yesterday corn and bean lows will probably be the low for the rest of 2023. The weather cannot get any better, shorts will cover before Friday’s S&D, demand is improving as weather in China, Europe, and South America is turning against farmers and the war is escalating. Tensions between Poland and Belarus continue to increase.

The nation’s corn and bean crops improved 2% in the good and excellent categories last week. The spring wheat crop lost 1% from the top two categories.

Corn is rated 57% good to excellent compared to 58% last year, which yielded 173.4 bu.

Soybeans are rated 54% good or excellent compared to 59% last year, which yielded 49.55 bu.

Spring wheat is rated 41% good or excellent compared to 64% last year. For all the details state by state on the all the crops, go to www.grainstats.com

Arlan Suderman, StoneX’s Chief Commodities Economist, reported customer survey corn yield estimate is 177.0 bushels per acre. Suderman’s yield model rose to 175.0, up from 172.5 the last week. USDA’s yields on Friday’s S&D supposedly will be based on conditions as of August 1st based upon farmer surveys and satellite data.

The low price of corn for the year was May 11th. It is up 9.5% since then.

Yesterday morning, the USDA announced the sale of:

132,000 mts of new crop soybeans to China

251,460 mts of new crop corn to Mexico

Tidbits

David Kruse of the Comstock report keeps track of the Eastern and Western Corn Belt. He reports the Western Corn Belt basis for old crop corn is 70¢ firmer than normal and the Eastern Corn Belt at 47¢ better than normal

The EU has no money available and no plan to help finance the extra transport costs of Ukrainian grain exports now that Ukraine’s deepwater ports are closed.

In the last 19 years, USDA has adjusted corn acres in August three times and bean acres eight times. Last year, USDA lowered corn planted acres by 100,000 acres and beans by 300,000 acres. USDA lowered acres again in September 2022 by 1.2 million on corn and 500,000 on beans.

Is there a chance to get $6.50 cash corn yet this month? Yes.

Basis in many places across the Corn Belt is 95¢ to $1.20 over the September futures and firming. September and December corn have not made a new low since July 13th. If corn was going to make a new low, it would have been yesterday. Given the crop condition and soil moisture, the market thinks it knows actual corn yields will not change much from where USDA is now at 177.5.

The December corn chart looks better yet:

CGB at Gladstone, Illinois Monday evening:

Cash corn: -7U (Sept) steady with previous day and fall delivery corn -30Z, steady

Cash beans: +68X (Nov) steady and fall delivery -30X (Nov) steady

Recorded Weekly Fertilizer market update 7 August 2023 by Argus:

ENSO Update:

Audio Version

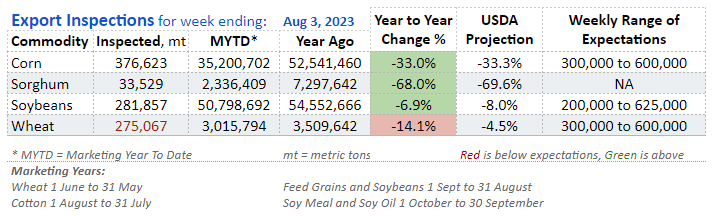

Export Inspections Tracker

Market Data

Prices are as of 3:00 am ET:

Crude oil is at $81.46, down $0.48

The dollar index is at 102.25, up 0.21

December palm oil is at 3,770 MYR, down 57. The contract high was made July, 24th at 4,210 MYR. Palm oil owns 61% and soybean oil owns 14% world market share.

December cotton is at $84.51, down $0.83 per cwt. The contract high was made July, 27th at $88.39 per cwt. Cotton competes with soybeans and corn for acres.

December natural gas is at $3.595, down 0.008. The contract high was made March, 24th at $3.805. Natural gas is the primary cost to manufacture nitrogen fertilizer.

December ULSD is at $2.8662 per gallon, down 0.0291. The contract high was made August, 4th at $2.9500. ULSD stands for Ultra Low Sulfur Diesel.

September Dow Futures is at 35,458, down 96. The lifetime high is 36,832 on January 5th, 2022.

Rain Days Update

The 6 to 10 day forecast updated every day at: https://www.cpc.ncep.noaa.gov/products/predictions/610day/

Explanation of Rain Days

Every day, every place in the world has a ten day weather forecast issued many weather services.

By a "place", we mean a Findlay, Ohio; Arcadia, Minnesota; Atlantic, Iowa; Fullerton, Nebraska; Cordoba, Argentina; Craig, Colorado, Saratov, Russia and ten million localities we have never heard of.

The ten day forecast predicts the high and low temperature for each day as well as whether or not rain is predicted for each of the ten days, likewise cloudy, partly cloudy, sunny, etc.

We look at the ten-day forecast and if we see rain is predicted for 4 of the next 10 days, we record a "4" for that location on the chart for the today. It does not matter whether it is one-hundredth of an inch or 5 inches. We realize about half the days expected to receive rain never get rain that day, but we must be consistent in what we report each day and every day because rain makes grain a few key weeks of the growing season. Of course, we scan the temperatures and the amounts of rain just to see if anything is getting way out of the norm.

Comments