Weekly Summary & Recommendations for Corn, Soybeans & Wheat 02/23/2022

- Wright Team

- Feb 24, 2022

- 2 min read

USDA announced this morning 132,000 mts of new crop soybeans were sold to China Note: RSI = Relative Strength Index; 70+ is over bought

Corn

Corn Situation after the close 22 February 2022 Even though we expected old crop futures to exceed $7, we recommended pricing 2021 corn when nearby futures were $6.24 to eliminate risk and prepare to buy puts when high is made this spring or early summer to make the money on the way down not made on the way up. December corn settled at $6.05¾ Price Change Tuesday to Tuesday: up 16 cents 20-month high $6.06¼ made 22 February 2022 20-month low $3.68¾ made June 26, 2020 20-month range is $2.37¼

Yesterday’s closing price is: ½ of a cent below the 20 month high $2.36¾ above the 20-month low USDA's 2020 crop carryout in terms of days’ use: US: 30, world: 94 USDA's 2021 crop carryout in terms of days’ use: US: 38, world: 92

Seasonal Trend is Up Fundamentals are Bullish Technical Situation is Bullish, somewhat over-bought RSI 72 Price Above Breakeven? Yes Conclusion: Don’t sell

The past week’s low was $5.85¾; the high was $6.06¾

This week's Bullish Consensus:

| Grainstats | Wright on the Market |

bullish | 54% | 64% |

bearish | 10% | 10% |

neutral | 36% | 25% |

no opinion | 0% | 1% |

Soybeans

Soybean Situation After the Close Tuesday, February 22, 2022:

We recommended pricing 2021 beans March futures at $14.78 to establish a floor even though we expected the old crop high to be early summer over $17.00 at which time, we recommend you buy puts to make money on the way down not made on the way up.

November Soybeans Settled at $14.73¼.

Price Change Tuesday to Tuesday: up 41¼ cents

18-month high $14.83 on 22 February 2022

18-month low $8.81½ on 7 August 2020

18 Month Range is $6.02

Tuesday’s closing price is:

9¾ cents below the 18-month high

$5.92¼ above the 18-month low

USDA's 2020 crop carryout in terms of days’ use: US: 21, world: 101

USDA's 2021 crop carryout in terms of days’ use: US: 27, world: 92

Seasonal Trend is up

Fundamentals are Bullish

Technical Situation Bullish, Over-bought, RSI 82

Price Above Breakeven? Yes

Conclusion: Don’t Sell

This past week’s low was $14.25½, high was $14.83

This week's Bullish Consensus:

| Grainstats | Wright on the Market |

bullish | 64% | 60% |

bearish | 10% | 14% |

neutral | 24% | 25% |

no opinion | 2% | 1% |

Wheat

Wheat Situation After the Close Tuesday, February 22, 2022:

We recommended pricing 2022 soft red winter wheat $7.97 in January. We have not recommended pricing July KC hard red winter wheat… way too dry and maybe war

July KC Hard Red Winter Wheat settled yesterday at $8.86½

Price Change Tuesday to Tuesday: up 76 cents

19-month high: $8.89¼ February 22, 2022

19-month low $5.03¼ August 24th, 2020

19-month range is $3.86

Tuesday’s closing price is:

2¾ cents below the 19-month high

$3.83¼ above the 19-month low

2020 crop carryout in terms of days’ use: US: 146, world: 135

2021 crop carryout in terms of days’ use: US: 122, world: 129

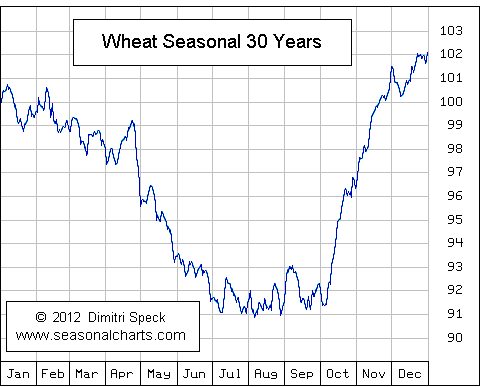

Seasonal Trend is down

Fundamentals are bullish, dry soil from Texas through Canada

Technical Situation is up, somewhat over-bought, RSI 76

Price Above Breakeven? Only if the yield is there, doubtful

Conclusion: Don’t Sell

Last week’s low was was $8.04¼; the high was $8.89¼

This week's Bullish Consensus:

| Grainstats | Wright on the Market |

bullish | 55% | 52% |

bearish | 13% | 6% |

neutral | 29% | 30% |

no opinion | 3% | 12% |

Comments