Tech Guy Weekend Comments 12/13/25

- Tech Guy

- 2 minutes ago

- 2 min read

January Crude Oil marked its low price 5 cents above the 57.10 support level, after selling off about 1.05 bucks from the high printed the evening before.

Feb support - 56.85, 56.10

Feb resistance - 58.00, 58.85

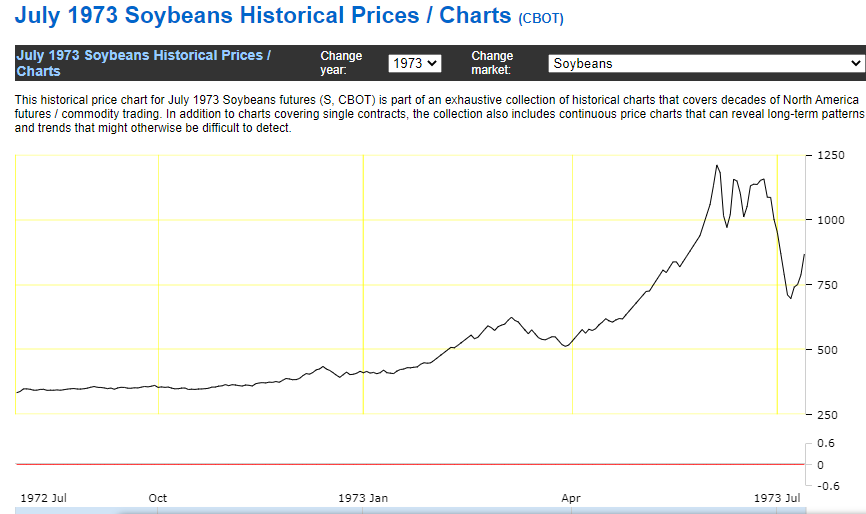

January Bean's breakdown to new lows indicates the probability of it targeting the previous 1072.00 support number. This area is also the top of an old gap.

support - 1072.00-1070.00, 1062.00

resistance - 1085.50, 1096.50

March Corn marked its low price 2 ticks above the lower stated 439.50 support number, after selling down about 7.25 cents from the evening high price print.

support - 439.50, 437.50

resistance - 443.50, 437.00

March SRW Wheat marked its low price at the stated 529.00 support level, then rallied about 5.25 cents, followed by selling off back to 529.00.

support - 529.00, 525.00

resistance - 532.50, 534.25

March HRW Wheat marked the low print 1 tick above the 517.50 support number, after selling off about 7.50 cents from the previous evening's high price.

support - 517.00, 513.00 - gap closure

support - 522.00-523.50, 526.00

March Spring Wheat marked its low print 2 ticks below the 574.00 support point, then rallied about 6.50 cents to the high print. Later, spring wheat drifted back down about 75% towards the low. Still rangebound, but showing signs of bull life.

support - 574.50, 570.00

resistance - 580.00, 583.00, 588.00

Note: These numbers can aid in determining entries or stops, depending which side you are on.

Ethanol:

Ethanol plants are already using 25% of Brazil’s corn crop and expanding every year.

For pertinent news and fundamental grain market information, sign-up for a 30 day, no cost, no obligation, no phone call subscription to Wright on the Market news sent to your email every day before you get out of bed. Click on "subscribe" at: https://www.wrightonthemarket.com/

Comments