Wheat, Corn Basis, Soybeans & Fuel Comments, Markets Update & Rain Days 03/09/2022

- Wright Team

- Mar 8, 2022

- 3 min read

The USDA will issue its monthly S&D today at noon Eastern Time.

USDA announced yesterday morning the sale of:

193,000 mts of new crop hard red spring wheat to the Philippines

132,000 mts of new crop soybeans to China

126,000 mts of old crop soybeans to unknown

After May wheat rallied yesterday from limit down to nearly unchanged, we all wondered what happened? Apparently, Putin has a lot of pull. He signed a decree banning commodity exports to the US and its allies through December of 2022. It is assumed to include wheat, but the list of commodities & countries is to be published on Thursday.

Last evening, the Gulf basis for corn was 5 to 7 cents firmer for March and April with soybean basis 5 cents firmer for March and 8 cents firmer for April.

The Illinois corn processor basis bids were up 30 cents, Indiana basis up 3 cents and Nebraska basis down 3 cents. Ethanol bids were unchanged to 6 cents firmer. Soybean processor bids were up 20 cents in Illinois and down 5 cents in Indiana. What is going on in Illinois?

South American grain trader Victor Martins reported after the close of the CBOT yesterday:

Staggering soybean meal and oil demand at Brazilian ports is propelling domestic crush margins, thus enabling crushers to outbid ports, increasing Brazil’s FOB soybean price. July delivery of soybeans is trading at $2.15 over August futures.

European Ag Market Analyst Mads Kristensen last evening said:

European (soybean) basis just skyrocketed this week, probably on increasing energy costs. CBOT so far pretty steady, but seems like it also starts moving now.

Darren Frye is a highly respected technician with Water Street Consulting in Peoria. He updated his crude oil analysis last evening:

If crude fails here between 125.20-126.71, it will be an X wave and I would expect a retracement down to $111.75 and maybe as low as $106.03. If we don't pause and rocket higher, then the $137 area is the next target. Not a recommendation, just analysis.

Diesel and jet fuel prices have skyrocketed about 50 cents per gallon nearly coast to coast. The cost to fill the fuel tanks on 777-300 just went up $22,600.

Javier Blas is Energy and Commodities columnist at Bloomberg. He wrote last evening:

The oil market is in complete denial if it thinks that more sanctions are not coming unless talks between Russia and Ukraine yield concrete results very soon.

The US Southern Plains (hard red winter wheat country) has another winter storm moving in, which is expected to bring much needed moisture for the winter wheat.

Market Data

This morning: Crude oil is at $124.79, up 1.09 The dollar index is at 98.79, down 0.27 July palm oil is at 6,485 MYR, up 555. The contract high was made today at 6,522 MYR. Palm oil owns 36% and soybean oil owns 28% world market share. December cotton is at $102.19, up $0.12 per cwt. The contract high was made February, 10th at $106.36 per cwt. Cotton competes with soybeans and corn for acres. July natural gas is at $4.685, up 0.015. The contract high was made March, 7th at $5.270. Natural gas is the primary cost to manufacture nitrogen fertilizer. July ULSD is at $3.6757 per gallon, up 0.0626. The contract high was made today at $3.7675. ULSD stands for Ultra Low Sulfur Diesel.

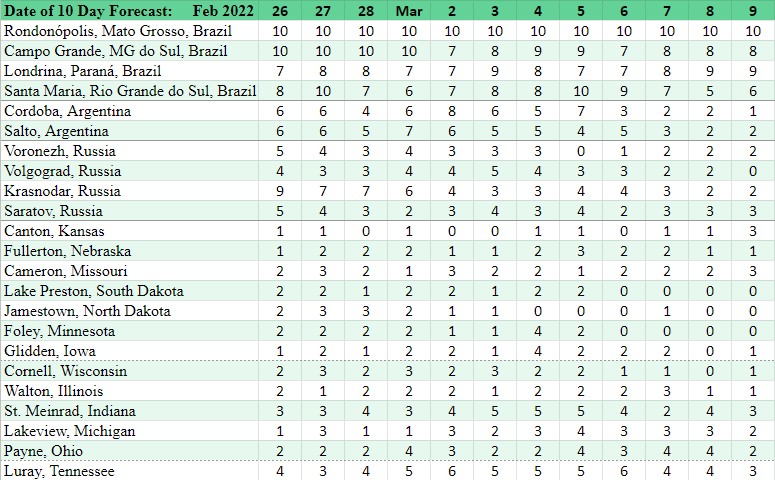

Rain Days Update

Yesterday, in the dry areas of South America: Santa Maria high temperature 87°F with 0.3 inches rain. Cordoba high temperature 68°F with 0.1 inches rain. Salto high temperature 90°F with 0 inches rain. Total rainfall and temperatures expected in the next ten days: Santa Maria 2.21 inches, 72 to 87°F. Cordoba 0.33 inches, 75 to 86°F. Salto 0.28 inches, 76 to 88°F. The Western Corn Belt has 4 more rain days in the 10 day forecast than yesterday and the Eastern Corn Belt has 3 less rain days than yesterday.

Comments