Market Moves, Veg Oil Deficit, Container Site, BC Vote, Markets & Rain Days Update 03/28/2022

- Wright Team

- Mar 28, 2022

- 4 min read

Highlights

Last week, corn was 22 higher, beans were 42 higher and wheat was 47 higher. The second most significant USDA report of the year will be released Thursday.

When a market moves sharply higher or sharply lower the 5 to 7 business days before a USDA report, those with profit in their futures account will take profit. They do not want to risk losing the profit already in their trading account by a surprise on the USDA report.

If the market had move smartly lower, short covering (buying futures to offset previously sold [short] contracts) will rally (move higher) the market.

If the market had moved smartly higher (as it was last week), those traders long the market (had previously bought futures contracts expecting higher prices) will liquidate their long positions by selling futures contracts to offset (cancel out) previously purchased contracts and the market will decline.

This process of the market declining after a rally the week before a report or vice versa is called “evening up” or “profit taking”.

After a big move up or down before a major USDA report, the only thing more certain than “evening up” or “profit taking” is the sun rise in the morning.

Do not be alarmed by this decline. The markets will over correct no later than Tuesday or Wednesday and then rally a bit before the reports are released at 10 AM Mountain time Thursday. Corn and beans will make new highs in a matter of one to ten weeks. Wheat making new highs is doubtful, but possible with the war in Ukraine.

Russian and Ukrainian negotiators will meet today in Turkey. Lower crude oil accelerated the weakness last evening.

HPAI version of bird flu at a turkey farm in Meeker County, Minnesota resulted in 289,000 toms being destroyed.

Oil World estimates the global deficit between the vegetable oil production of the top ten oilseeds and the consumption at current prices will be 19 million mt.

It would take 218 million bushels of soybeans to produce that much soy oil. The projected US soybean carryout is presently 285 million bushels. Veg oil prices will have to go high enough to remove 19 million mt of demand if Oil World is correct.

The USDA has partnered with the Northwest Seaport Alliance (NWSA) for a 49-acre “pop-up” container site in Seattle, where grain logistics providers can drop off their exports.

This should result in quicker pick-ups of empty boxes, improve access to available equipment and less congestion for truckers.

As part of the plan, the USDA's FSA will make payments to agricultural companies and cooperatives that place shipments at the pop-up site of $200 per dry container and $400 for a reefer.

The NWSA reported a drop of nearly 30% in exports of agricultural commodities in the second half of 2021 from 2020, while the ratio of loaded versus empty containers leaving the port complex had shifted to predominantly empty boxes since May 2021.

The two biggest issues the west coast ports have is container yard space and labor productivity.

The USDA’s agreement with the NWSA follows a similar arrangement with the port of Oakland at the end of January to set up a 25-acre site for containerized agriculture exports.

The US Department of Transportation spent $8 million last fall for the creation of pop-up container storage yards in Savannah, Georgia. It did take the pressure off the port’s container facilities.

The USA will supply 15 billion cubic meters of liquefied natural gas (LNG) to the European Union this year to help it wean off Russian energy supplies. The deal was announced Saturday.

Note: that would be 10% of what the EU bought from Russia in 2021.

The EU has a goal to reduce its purchase of Russian natural gas by two-thirds this year and end all Russian fossil fuel imports by 2027. Russia currently supplies about 40% of Europe’s natural gas. EU countries have placed heavy economic sanctions on Russia.

Finland’s Wartsila, a leading ship engine maker, has suspended business with Russia including training how to operate equipment already delivered.

Bullish Consensus Vote

We appreciate you sharing weekly sentiments on wheat, corn and soybeans, takes a few seconds. If you haven't voted since the last Wednesday, please vote at https://www.wrightonthemarket.com/vote We publish weekly results every Wednesday.

Market Data

This morning:

Crude oil is at $109.24, down $4.64

The dollar index is at 99.25, up 0.48

July palm oil is at 5,822 MYR, down 36. The contract high was made March, 9th at 6,531 MYR. Palm oil owns 36% and soybean oil owns 28% world market share.

December cotton is at $113.65, up $1.91 per cwt. The contract high was made today at $114.00 per cwt. Cotton competes with soybeans and corn for acres.

July natural gas is at $5.701, steady. The contract high was made today at $5.796. Natural gas is the primary cost to manufacture nitrogen fertilizer.

July ULSD is at $3.2880 per gallon, down 0.0894. The contract high was made March, 9th at $3.7675. ULSD stands for Ultra Low Sulfur Diesel.

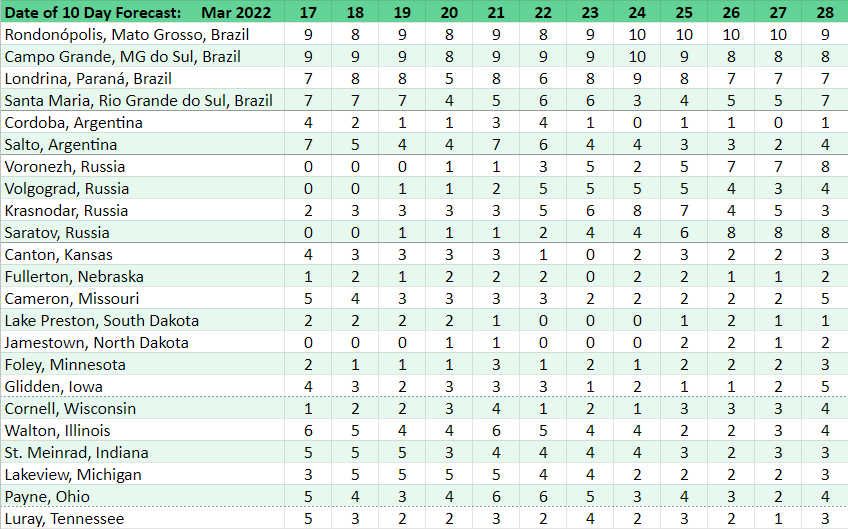

Rain Days Update

Yesterday, in the dry areas of South America: Santa Maria high temperature 83°F with 0 inches rain. Cordoba high temperature 94°F with 0 inches rain. Salto high temperature 88°F with 0 inches rain. Total rainfall and temperatures expected in the next ten days: Santa Maria 3.66 inches, 67 to 90°F. Cordoba 0.22 inches, 66 to 88°F. Salto 0.72 inches, 65 to 84°F.

The Western Corn Belt has 10 more rain days in the 10 day forecast than yesterday and the Eastern Corn Belt has 5 more rain days than yesterday.

Comments