top of page

BASIC & RECENT MARKET INFO

True Tales of Grain Marketing & Educational Articles are available for free to cover the main stuff!

And Daily Reports feed are there to advise you.

Explore by categories or all posts by date.

Try Our Daily Grain Market Reports and the Tech Guy's stuff

FREE for 30 Days!

Featured Posts:

Search

Tidbits, Stocks & Treasuries, Electricity & Water, Brazil’s Crops, ENSO, Export Inspections 1/21/26

Tidbits Exports: Yesterday morning, the USDA reported sales of 190,000 mts of old crop soybean meal to the Philippines. News sources indicate China has likely reached its 12 million mts commitment of U.S. soybeans purchases for the 2025/26 marketing year, and that further purchases are unlikely until September unless prices are competitive with South American soybean prices. Most of the volume is heading for reserves and is 47% fewer than China bought in 2024/25. The USDA pur

Wright team

Jan 214 min read

Tidbits, USDA September Stocks & Estimates, Costs Audit, Middle East, China PMI 10/1/25

Tidbits The corn stocks number yesterday was 82 million bushels higher than the highest estimate and 196 million bushels more than the average estimate. Yesterday’s low on December corn was lower than the last two lows made on corrections after making new highs for the move in September. The trend of higher highs and higher lows since 12 August has been broken and the price went below the 20-day moving average, which is a bearish technical indicator. However, the SuperTrend

Wright team

Oct 1, 20254 min read

USDA September Quarterly Stocks Numbers 9/30/25

The numbers were: Negative to Bearish Corn and Wheat Neutral Soybeans CBOT 30 Minutes After Report Dec corn -6 Nov beans -8 July CBOT...

Wright team

Sep 30, 20251 min read

Tidbits, US Agricultural Support, Brazil Fertilizers, Marketing Years, USDA Stocks Estimates 9/28/25

Tidbits Ag support: Secretary of Agriculture, Brooke L. Rollins announced last week an aggressive three-point plan that will support American agricultural producers and exporters. “President Trump is putting American agriculture first by negotiating fair, reciprocal deals that benefit U.S. producers, farmers, and ranchers,” said Under Secretary for Trade and Foreign Agricultural Affairs Luke J. Lindberg. “Secretary Rollins is focused on expanding market access, enforcing tr

Wright team

Sep 28, 20255 min read

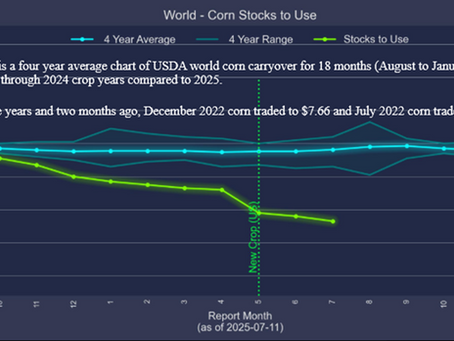

Tidbits, Stocks to Use & Pipeline Supply, FOB 7/14/25

Tidbits Eduardo Vanin of AgrInvest Commodities of Brazil corn and soybean Saturday comments: "Brazilian soybeans shipped in September are among the most expensive on the market, surpassing those of the US and Argentina, making negotiations with China difficult. Meal, in turn, is so cheap that even Argentine shipments are competing with local products in Asia, creating a scenario of tight crushing margins. Meanwhile, soybean premiums (basis) rose 20 cents this week, and Braz

Wright team

Jul 14, 20255 min read

Tidbits, Stocks & Acres, Trade Negotiations, ENSO, Export Inspections 7/1/25

Highlights The USDA Grain Inventory and Actual Planted Acreage Reports were so absolutely neutral, that the biggest news of the day from USDA was the corn crop conditions added 3% this past week to the top two condition categories after losing 2% a week ago. Soybean crop condition ratings were unchanged. Corn stocks were less than a year ago and almost as expected. Of the remaining old crop corn, 2.556 billion bushels (3.026 a year ago) were still on the farm and 2.087 billi

Wright team

Jul 1, 20255 min read

USDA Acreage & Stocks Numbers 6/30/25

The numbers were: Neutral Corn Unfriendly Old Crop Soybeans Friendly New Crop Soybeans Unfriendly Wheat 15 minutes after the report:...

Wright team

Jun 30, 20251 min read

Tidbits, Grain Stocks, Weather, Biofuel, FOB 6/30/25

Tidbits At 11 AM Central Time today the USDA will release the most important reports of the year. The Grain Stocks report will set the wheat carryover for old crop and the carryin for the new crop marketing year. Those numbers will never change significantly and are unlikely to change at all. The stocks reported for corn and soybeans will be what we have left for the last three months of the corn and soybean marketing years. It will give us a good idea of what the old crop ca

Wright team

Jun 30, 20254 min read

Tidbits, Technical Analysis, Stock Markets, Oil World 10/7/24

Tidbits Stock markets around the world kick-off today with the global macro and market landscape very different from how it looked on Friday morning thanks to a set of U.S. employment figures that not even the most bullish of forecasters expected. The immediate shift in U.S. interest rate futures markets indicate a 50-basis point rate (one-half percent) cut next month is now completely off the table. The markets signal a quarter-point cut at each of the next two Federal Ope

Wright team

Oct 7, 20244 min read

Tidbits, USDA Stocks Report, Harvest Progress, ENSO, Export Inspections 10/1/24

Highlights Nothing in yesterday’s reports changed our price outlook. We expected neutral to somewhat friendly numbers and that is what USDA gave us. USDA reduced the size of the 2023 U.S. soybean crop by 3 million bushels to 4,162 million bushels. USDA did not change the 2023 corn production. The biggest surprise, but not a big one, was corn demand was substantially more (84 million bushels) than the market expected. That was a 0.56% increase in demand and a reduction of 4.

Wright team

Oct 1, 20244 min read

USDA Stocks Numbers 9/30/24

The numbers were: Friendly Corn Neutral Soybeans Neutral Wheat 16 Minutes After the Report: Dec corn +6 Nov beans -2 Dec CBOT wheat +8...

Wright team

Sep 30, 20241 min read

Tidbits, Crude Oil, Stocks Reports, Export Sales 9/27/24

Highlights This is Friday before a harvest weekend. Look at the weather across the Corn Belt and decide if pre-hedging pressure is a reason for you to make a minor adjustment to your marketing plan for the day. Also, the USDA Quarterly Grain Stocks Report is Monday at 10 AM Mountain Time. Chinese leaders pledged to deploy “necessary fiscal spending” to meet their economic growth target of 5%. There are reports that China is considering injecting 1 trillion yuan of capita

Wright team

Sep 27, 20244 min read

Tidbits, Stock Market Decline, Crop Conditions, ENSO, Export Inspections 8/6/24

Highlights Japan's stock market suffered its second largest stock market decline ever on Monday, world markets followed. Not that it was anything Japan did to cause the sell-off. The world-wide sell-off was triggered by the US economy showing much higher unemployment and many fewer new jobs than expected on Thursday. The Fed should have been cutting interest rates last month as the US economy was on an inflation-controlled landing pattern and the Fed did overshot the

Wright team

Aug 6, 20244 min read

Tidbits, S&P Futures, Artillery Shells, Market Commentary - Grain Prices 7/22/24

S&P Futures We have often mentioned that selling cash corn, beans, or wheat and replacing it with a futures or options position of that same commodity often is not the best strategy at the time. The reason to re-own a commodity is to make money. Often, the best opportunity, the best risk/reward ratio to make money with futures or options is with a different commodity than the commodity just sold. We have clients who bought cocoa puts in the spring, wheat puts in May,

Wright team

Jul 22, 20244 min read

Tidbits, Hurricane, Stock Market, Broilers & Ethanol 7/18/24

Highlights Eric Snodgrass: "We use that term derecho when we’re talking about a storm system that produces damaging winds over at least a 400-mile swath. That’s certainly what we got out of this as it went through it produced over 850 reports of severe wind damage, including some tornadoes, along with those really strong winds." Snodgrass says the system, which hit some areas recently impacted by the remnants of Hurricane Beryl, also caused widespread flooding issues. "I

Wright team

Jul 18, 20244 min read

USDA June Stocks and Acreage Numbers 6/28/24

These are Benson-Quinn's USDA Numbers. We have no reason to think they are not actual USDA numbers. If they are the actual numbers, some...

Wright team

Jun 28, 20241 min read

Tidbits, Grain Stocks & Market Reactions, Markets & Rain Days Update 9/30/23

Highlights In yesterday's Quarterly Inventory and Small Grains Summary Reports, the USDA reduced the size of the 2022 corn crop by 15 million bushels, 4 million more than expected. USDA also reduced the 2022 soybean crop by 5.93 million bushels, about 1 million bushels less than expected. More importantly, the inventory of corn in the USA on September 1 was less than expected for the third consecutive quarter, this time 68 million less than expected, which is 1½ days’ wort

Wright team

Sep 30, 20233 min read

USDA Stocks Report Numbers 9/29/23

The 2022 corn for grain production is revised down 15 mil bu. Corn harvested for grain is revised to 79.1 million acres, down 100,000...

Wright team

Sep 29, 20231 min read

Tidbits, Quarterly Stocks Estimates, Markets & Rain Days Update 9/27/23

Highlights Dr. Cordonnier cut his US corn yield estimate by 1.5 bu to 171.5 and reduced bean yields by a half bushel to 49.0. The meteorological firm, Climatempo, is calling for temps over 100 degrees across central Brazil (where 85% of their beans are grown) as the country continues to struggle with hot and dry conditions during planting. Producers are being warned by agronomists to wait on planting beans until adequate moisture arrives to ensure germination and stand estab

Wright Team

Sep 27, 20234 min read

Tidbits, SA Rains, Hedge & Stocks, Markets & Rain Days Update 1/3/23

We apologize for yesterday's email stating the price changes of the outside markets. Certainly some of you had a near heart attack when we reported the markets were trading when you thought they were not. You were correct, they were not trading. Crude oil started trading last evening and the ag commodities will open at 8:30 AM Central Time this morning. A lack of attention to detail is a vice, especially in our business as a service to you. Again, we apologize. Be at war with

Wright Team

Jan 3, 20235 min read

bottom of page