Roger's Outlook for World Agriculture April 2019

- Wright Team

- Jun 10, 2021

- 12 min read

Long Term Outlook

The obvious conclusion is world population is increasing and more people require more food and fiber. In the ten years ending in 2000, world population grew 1.4% per year; during the next ten years, the annual growth rate was 1.2% and the annual growth rate from 2011 to 2020 was projected to be 1%. However, China’s change of policy from one child per family to two children per family became law in January 2016 and that may bump the population growth a bit more than predicted.

Developing countries had 79% of the world’s population in 2000, but by 2027, 83% of the world’s population will reside in developing countries. Developing countries are not among the world’s leaders in food production. Thus, the more developed countries will have expanding markets for their food and fiber production.

A very important aspect that politically correct world leaders and the media do not want to talk about is the decline of government stability, and thus food production, of nearly all of Africa.

As African countries progressively gained independence and self-governorship, beginning in the mid-1950’s, thousands of years of tribal competition and racial prejudice progressively raised their ugly heads. A classic example is the Rwandan genocide against the Tutsi tribe Rwanda during the Rwandan Civil War which was directed by members of the Hutu majority government between 7 April and 15 July 1994. An estimated one million Rwandan Tutsis were killed with machetes, about 70% of the Tutsi tribe. Somali had no government at all when the US tried to arrest key “war lord” faction leader Mohamed Farrah Aidid in 1993 (Black Hawk Down). Independence for Belgian Congo in 1960 resulted in five years of civil war. Since then, the governments have mostly been a revolving door of dictators. There are several other African countries with similar history of unstable governments.

For 30 years, I reported corn production from South African as it was the third leading corn exporting country. However, as lawlessness increased after the end to Apartheid in the early 1990’s, farm production has been in a steady decline. White farmers are being murdered in their own homes and fields by black thugs to this day and the government quietly looks the other way as the national policy is that all land rightfully belongs to and will be returned people of color. Consequently, because crop production declined, I stopped reporting South African corn production as their production has become rather insignificant in the world market place.

The first civil war in Sudan was from 1955 to 1972 and the second civil war was from 1985 to 2005. Since 2003, violence in Darfur Province of Sudan has left an estimated 50,000 to 80,000 dead and an estimated 1.2 million to 2 million people displaced. Survivors face severe shortages of food and clean water. Sudan is the largest country in Africa.

Meanwhile, Libya and, to a lesser extent, Egypt have fallen into chaos at times the past ten years. Nigeria has had civil wars off and on since the transition to self government in 1960 to 1963. Sadly, world leaders blame global warming for the steady decline of food production on the African continent as well as GDP since 2005. I see no return to stability of food production in Africa until world leaders get their heads out of the “global warming” sand trap and deal with the real problem.

As world food production declines in Africa, world demand for corn, wheat and beans has increased the past ten years to the tune of 19.9% for wheat, 55.7% for corn and 54.8% for soybeans according to the USDA. See Exhibits “A” and “B”.

Not only is world population increasing demand for food, every year, millions of the world’s people are moving from poverty and lower economic classes into the middle class. With more income, these former poverty-stricken people have the capability to buy higher quality food. That means they are moving away from grain-based diets to fish, dairy products, poultry, pork and beef. While liberals decry animal agriculture as being inhumane and wasteful use of grain, the fact is people like to eat animal protein and, given the financial opportunity to buy animal protein, they will. Having a lack of grain to feed animals to meet the world’s growing demand for animal protein is a problem only in the minds of ignorant people. Again, see Exhibits “A” and “B” world use.

For USDA’s US and World Supply and demand Reports, go to:

Environmental Reports: Food Matters:

Historically, demand for increased crop production was driven largely by wealthy countries in North America and Europe, and this population will be joined by an additional 3 to 4 billion people already on Earth who are getting wealthier, mostly in India and China. Richer people tend to want richer foods, including meat and dairy products. It’s likely that two-thirds of the growing crop calorie demand will result from growing affluence.

Food production needs to increase 70% in the next 30 years to feed 9.6 billion people in 2050.

2

Short Term Outlook

Each of the past four years, US farmers have produced corn and bean yields that were more than the trend yields for each of those years contributing greatly to depressed prices that have generally been at or below the cost of production for most producers. The Eastern Corn Belt farmers are fortunate to have much firmer basis than their fellow producers in the Western Corn Belt. That amounts to a 20 to 40 cent advantage on corn and 30 cents to a dollar on beans. Generally, American farmers are quite discouraged about their P&L outlook as they prepare for the 2019 growing season.

Ethanol

In September 2017, China announced a nationwide mandate for 10% ethanol blend beginning January 2020. With more than 300 million cars in 2017, China has more motor vehicles than any country in the world and about 40 million more automobiles than the USA, where year-around use of E15 (15% blend of ethanol with gasoline) will become available perhaps as soon as June 2019.

In 2016, China was the third biggest market for US ethanol, taking nearly 20% of US exports, according to the Renewable Fuels Association. But after two years of rising trade tensions, China took just 4% of US ethanol exports in 2018 after China slapped a 30% tariff on US ethanol in 2017 and increased it to 45% in 2018.

In order to meet its 2020 demand for ethanol with domestic production, China must build 36 huge plants each producing 102 million gallons of ethanol a year, which they probably cannot do buy January. In any case, that much ethanol will take about 1.4 billion bushels of corn. Market-wise, it matters very little if China uses their corn or buys corn from the US or buys ethanol from the US. China’s ethanol demand will grow nearly sevenfold to introduce E10 fuel throughout the country next year. That use alone will use 3.1% more corn per year. World corn use has annually expanded 5.5% the past ten years without China’s ethanol mandate.

A very simple partial solution to the trade deficit issue the US has with China is for China buy all the ethanol they need from the US and then, if they wish, buy our corn to make ethanol.

It is not likely that the change to year-around E15 availability in the US will substantially increase ethanol demand immediately, but it is certainly a large step in the right direction. Most gasoline suppliers do not offer E15 because it is presently not allowed to be sold between June and September. Ethanol proponents hope that when E15 is legal to sell year-around, retail outlets across the USA will switch their supply tanks from E10 to E15. Since ethanol generally costs less per gallon than gasoline, an E15 blend will be less costly than E10. E15 is safe to use in any automobile built after 2000.

Brazil mandated 4.5% ethanol blended gasoline in 1977 and has steadily increased that percent

to the current 27%. That percentage is expected to continue to increase.

3

The failure of technology to enable the economic production of ethanol from cellulose (forages) has been a major disappointment to the ethanol industry, but a boon for corn producers because Brazil has more grass than one can imagine. Consequently, Brazil must use either sugar or corn to produce their ethanol. Even though sugar based ethanol is less expensive than corn based ethanol, there has been great resistance in Brazil to use sugar, their most exportable crop for centuries. Thus, Brazil was a major destination for US ethanol the first seven years of this decade. However, a tremendous sugar crop in 2018 has caused a sharp reduction in US ethanol exports to Brazil. In August 2018, only 105 barrels of US ethanol were shipped to Brazil compared to 583,400 barrels in August 2017, just before the 20% tariff went into effect in September 2017. At the time, Brazil said they would “revisit” the tariff within two years. That “revisit” started in February 2019 when the Trump administration asked Brazil to remove the 20% tariff on ethanol imports in excess of 150 million liters per quarter. Brazil’s president, Jair Bolsonaro, took office in January 2019. He is a huge supporter and imitator of Donald Trump. Bolsonaro seeks to cool relations with China and improve relations with the USA. It is reasonable to expect that Brazil’s ethanol tariff will be reduced in a matter of months.

China’s Ministry of Commerce confirmed it is starting a review today (15 April 2019) of its anti-dumping tariffs on imports of distillers grains (DDGS, by-product of corn ethanol production and a valuable feed source) from the United States. The agency reported the investigation should be completed in a year...

Biodiesel

Taking effect in 2020, Brazil’s RenovaBio program mandates use of biodiesel and ethanol as a percentage of overall fuel consumption. Consequently, Brazil’s use of biodiesel will most

definitely increase substantially in 2020. Soybean oil is the major oil used for biodiesel

production. In 2017, 6.2 billion pounds of soy oil were used for biodiesel production in the USA and on pace to grow to 7.3 billion pounds of soy oil for biodiesel in 2021. That is about 28% of the bean oil annually produced in the USA.

4

Livestock

The US has 2% more hogs than a year ago, 2% more broilers being added every week than the corresponding week a year ago, cattle placed on feed in February 2019 were 2% more than the previous year. Dairy cattle numbers are rapidly declining, but dairy cattle eat very little corn and even less soybean meal because they are ruminants.

The biggest news in production agriculture the next 3 to 4 years will be recovering the loss of animal protein due to African Swine Fever (ASF) in Asia, most notably in China where 1.3 billion people live. ASF does not infect humans, but it deadly for hogs and there is no cure. To stop the spread, all hogs that have the remotest possibility of being infected are destroyed.

Nine months ago, China had its usual 52.5 million head, more hogs than the rest of the world combined! The USA is the world’s second largest producer of pork with “only” 22 million head. Global Meat.com reported last August that ASF from Kazakhstan spread east through Russia, Mongolia into China and west into Ukraine. By January, ASF was detected in every Chinese province, Vietnam and Cambodia. Two months ago, ASF was detected in Romania and Belgium. Therefore, pork from Europe is not likely to be used to help fill the protein void in China.

5

About two months ago, the estimates of hogs destroyed in China went from 2% to 30% to as high as 35% and the disease is not still contained. Even China, famous for understating negative facts, admits their swine breeding stock is down 21%. Non-Chinese veterinarians in China report the loss is easily 30% and probably 35% and expanding.

During the past winter, the market’s attitude was the demand for corn and soybean meal would be hurt progressively more by ASF. China is the world’s largest consumer of soybeans, soybean meal and soy oil and second largest user of corn. Given the trade problems between China and the USA the past year, gloom and doom was the forecast for the soybean and corn markets as ASF spread across China.

However, as a few brave souls predicted five months ago, about a billion Chinese people have gotten used to eating pork and they are not going to go back to eating rice without their pork. US Pork exports to China began to accelerate in February and exploded in March. Brazil will get a big piece of the pork export pie, but hogs eat corn and soybean meal whether they are in Brazil, China or the USA. Brazil has a history of their own of livestock disease problems, so they may not be a big player in the pork to China export business, especially since Brazil’s president is cooling relations with China to slow the flow of Chinese investment money into Brazil to reduce their influence on his country’s economy. He knows Chinese culture is to gain enough influence to become the power broker of industries and nations.

For the week ending April 4th, 2019, China’s purchases of US pork climbed to the highest level in at least six years as the USDA reported 77,732 mt of US pork were booked for export to China in that one week. All this US pork has a 62% tariff applied when it arrives in a Chinese port. How long will that last? I predict not very long.

A month ago, estimates were China would buy 300,000 mt of US pork in 2019. Last week, that estimate was changed to 200,000 mt by the end of June and no one has been brave enough to predict pork exports the last half of 2019.

6

US hog prices paid to farmers have rallied 55% since March 6th ($51 to $79 per cwt). Swine breeding stock in the USA as of March 1st were 2% more than a year ago and that number is most certainly increasing… and increasing a lot with the recent surge in hog prices. The market will be shocked by how much corn and bean meal will be consumed as feed in the coming three years. Why?

RaboResearch Food & Agribusiness expects Chinese pork production losses of 25% to 35%. I would say that is a conservative number. None-the-less, that loss is at least 30% larger than annual U.S. pork production and nearly as large as all of Europe’s annual pork production. ASF could result in a net supply gap of almost 10 million metric tons in the total 2019 animal protein supply. Christine McCracken, RaboResearch animal protein analyst, says other proteins and larger pork imports will not be able to keep up with the protein demand. It takes little imagination what that would mean for animal as well as plant protein prices.

Despite all this news, the big speculative commodity futures trading funds have been short (sold positions expecting to buy-back cheaper) the corn futures since the end of 2018. Despite the disastrous March floods in Nebraska (3rd largest corn producer), parts of Iowa (largest corn producing state), Missouri and South Dakota, the big speculative funds aggressively added to their short futures position to reach a record large short by the end of March. Foolishly, they added another 122.6 million bushels of corn to their short position the week ending April 9th. The big spec funds are now short 1.478 billion bushels of corn! All those bushels have to be bought back at some future date. The USDA predicts there will only be 2.035 billion bushels of corn in the USA on August 31st (see Exhibit “B”).

7

The big spec funds have been successful in pushing the corn market down about 30 cents per bushel the past three months, much to the distress of America’s corn farmers who quit selling corn about two weeks ago at these depressed prices. Commercial corn users are finding it very difficult to buy corn. They are bidding-up the basis in an effort to buy cash corn. The problem for commercials is corn futures contracts cannot be fed to livestock or made into ethanol. Non-the-less, commercials (users of corn) bought 139.46 million bushels of corn in the week ending April 9th to lock-in what they see as a good value for cash corn user.

The world supply of soybeans is considered overwhelming by the market, especially in the face of the trade tiff between the USA and China. None-the-less, soybeans prices have held about 60 cents to $1 a bushel above last September’s lows. The best cure for low prices is low prices because production goes down and consumption goes up. Bean acres in the US are expected to be about 2 million fewer than a year ago while soybean meal demand is steadily increasing for livestock and the lower price of soy oil is benefiting biodiesel market place as diesel fuel prices are rising with crude oil prices. The 1400+ consumer and industrial products made from soyoil are less costly and sales are logically expanding. Again, low prices stimulate demand.

Summary

Before US pork exports began to ramp-up, I expected corn prices to reach price levels in 2019 we have not seen in four years, something a bit over $4.50 per bushel. Now, I am reluctant to even put a target price on the top side. As corn prices climb, so will soybeans and, to a lesser extent, wheat as corn will “buy” acres away from beans, wheat and cotton. Four consecutive years, US farmers have beat the trend yield for both corn and beans. The law of averages says it is highly unlikely it can be done five straight years. The big unknown is what will the current El Niño episode do to crop production around the world? It most certainly will cause production problems.

For the Corn Belt, El Niño brings cooler than normal temperatures with above normal rainfall. The biggest risk to the US corn crop in an El Niño growing season is a spring so wet, the corn crop does not get planted in a timely manner. However, that risk is usually negated by the fact that US farmers can plant all their corn in five days! Corn planting is already 3% in the ground and the chances of not having five days of field work between now and June 4th are very remote, El Niño or no El Niño! The only year El Niño damaged the US corn crop was 1993. All other strong El Niño years resulted in record corn yields!

Worldwide, weeds are the largest cause of crop loss, taking 34% of crops. Insects are second with 18% loss and plant disease takes 16% of the world’s crop. Enabling farmers to economically control these pests through variety selection, fertility, timely application of specific pesticides, and precision agriculture is the business of Novus Ag.

8

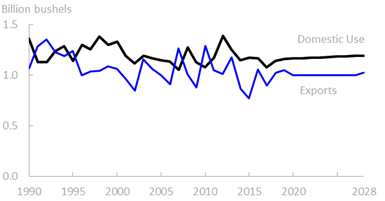

US Soybean Use 1990 to 2028 as of February 2019

U.S. soybeans: Domestic use and exports

US Corn Use 1990 to 2028 as of February 2019

US Wheat Use 1990 to 2028 as of February 2019

Comments