Market Commentary for 6/23/25

- Jon Scheve

- Jun 22, 2025

- 2 min read

Jon Scheve with weekly market commentary made on June 20, 2025

December corn finished its third week of closing between $4.35 and $4.50. In the last 77 trading sessions, Dec corn only closed above $4.55 11 times, and never above $4.70.

No Opportunities:

There have been virtually no opportunities to sell 2025 corn at a profitable value in the past year. After reviewing breakeven levels with many farmers throughout the US, it seems the average farmer in the country needs a $4.75 futures value with normal yields to turn a profit this season. As this chart shows, in the past year there were only 4 days where the price point was above the breakeven.

November beans managed to get a small boost from the biofuel mandate goals released last week and traded within one cent of the highest value seen in 2025. Unfortunately, that price point is still at least 50 cents below the breakeven value for the average US farmer. Similar to corn, this chart shows that 2025 November beans haven’t had any profitable opportunities for over a year.

The market hasn’t given US farmers a chance to sell their 2025 grain at a profit. Even if farmers choose to sell grain before last June, it would have been very risky, because 2025 fertilizer costs weren’t fully known back then. Plus, for those renting land in 2025 their rent values were not yet known. Additionally, the 2024 and 2025 summer weather risk demanded a much bigger risk premium compared to the estimated breakeven levels that were being calculated for a crop 18 months away from being harvested.

What Can Farmers Do?

The biofuel mandate has given soybeans some upside potential. It may not happen right away, but by next year we may look back at this time as to when the bean market turned around and maybe it will even pull corn out of the gutter.

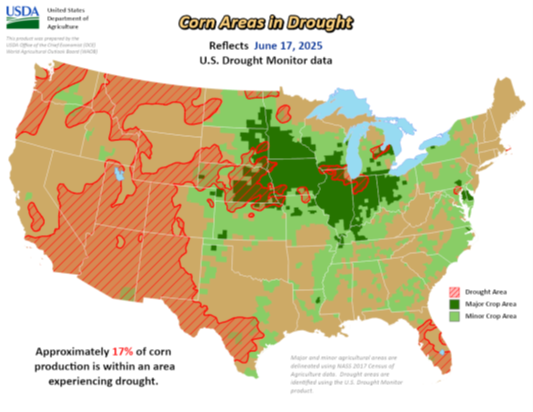

Corn values can still be heavily impacted by weather. Right now, only 17% of corn is experiencing dry conditions.

This means funds see no reason to cover their short yet. However, if a high-pressure system would move over key growing areas in July, corn could rally significantly. If weather could be predicted, then prices could be predicted too.

Bottomline:

The corn and bean markets have not provided US farmers with any opportunities to turn a profit this year. Luckily, the highest prices of the year occurred during the insurance averaging period. This could mean everyone is farming for insurance this year. Historically though, since the ethanol mandate 20 years ago, December corn has always managed to surpass the spring insurance prices eventually. Another stat to keep in mind is that February has not seen the high for the year since before 1990. Unfortunately, past performance is not indicative of future results.

Programing Note:

I was on US Farm Report this weekend talking about the upcoming June acreage and stock report. Click here to watch: Are You Worried About Marketing Old Crop Corn? Here's Some Advice

Jon Scheve

Superior Feed Ingredients, LLC

9358 Oak Ave

Waconia, MN 55387

Comments