Tech Guy Opening Calls & Comments 11/7/22

- Tech Guy

- Nov 7, 2022

- 2 min read

Dec Wheat - Steady to 1 Lower

Dec Corn - Steady

Jan Beans - 4 to 5 Lower

The 35 day cycle was last Friday and today is 38 days since the last time marker in the corn and bean markets. We are to expect a swing high, swing low, or some sort of inflection point or pivot.

Last months cycle point was only 3 or 4 days from the low in Nov Beans and very near a low point in Dec Corn's sideways channel. This go around, the cycle point appears to be a swing low in Dec Corn and a high in Jan Soybeans. Remember, sometimes this node is not a significant high or low but rather, just a bump in a bigger trend.

The US Dollar had follow through selling today - down minus .709 to 110.6, Therefore we have a bit more information - it is most likely going down to test the 109 area which will be a triple low point.

How the Dollar behaves at this triple low will determine if we are looking at confirmation of a major swing high on the weekly chart or not, and as I have said the odds are favoring this scenario. It will be very supportive for grains, crude, and most US markets.

I believe you will see what I am saying by looking at the static US Dollar chart below - notice the high in late September as well as all the other lower high points and lower low pivots.

It has been 5 days since the low of 70.1 in December Cotton and has not offered a good pullback for longs yet, closing today near it's high for the move at 87.49. The most likely scenario is still for cotton to eclipse 90 or 91 on it's way to 120 or higher (where the range is on the left before the down move) then backfill to the 83-81 level before another leg higher.

The 414.5 area in Dec Soymeal has continued to provide support for 3 days now. My bias short term is for it to work higher. It closed today at 418.9. Jan Soybeans made a slightly higher high of 1469 and then sold off today, as anticipated. Beans ended up closing at 1449.75 and should eventually find it's way down to the 1420-1425 area where I anticipate fund buyers will be waiting.

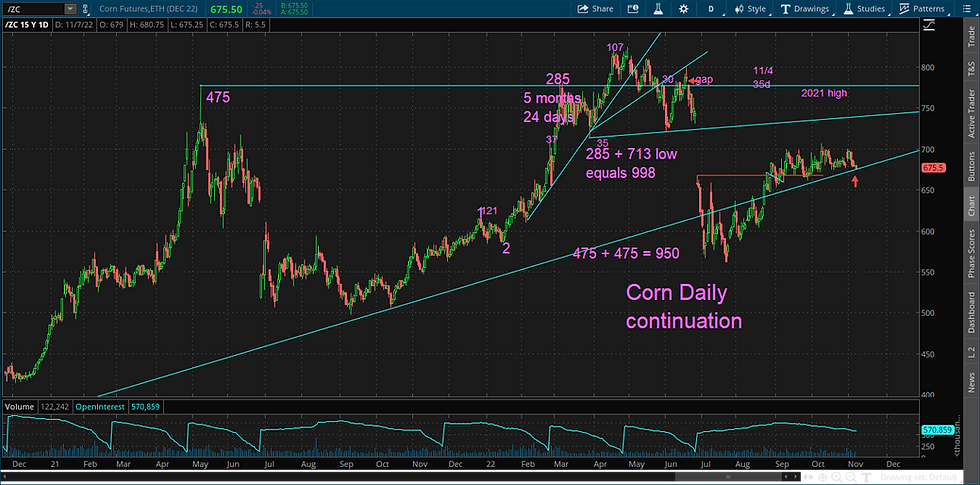

Dec Corn continues to trade in the lower half of the sideways channel. I rediscovered an old daily trend line supporting this channel. It is the line that began with the lows in 2020. Check it out here:

The 830 to 840 area continues to be support in Dec Wheat and 93.74 today proved to be resistance in Dec Crude Oil - it may pullback as far as 90, but that should be it.

Comments