Market Commentary for 6/10/24

- Jon Scheve

- Jun 9, 2024

- 2 min read

Jon Scheve with weekly market commentary made on June 7, 2024

This week we saw the first crop conditions released, and the assessment was the crop is starting off in really good shape. Additionally, the market senses the corn crop will get planted, but how many acres will there be?

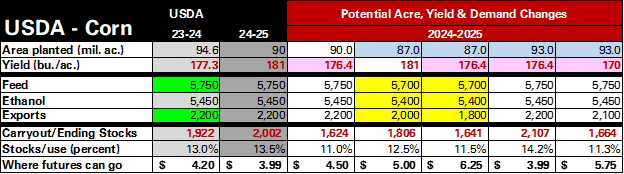

Corn acre estimates for the June 28th report are ranging between 87 million and 93 million, which is a very wide spread. Assuming 180 bushels can be raised on each acre, that is a 1-billion-bushel production difference.

A 1 billion bushels change in carryout could mean a 2.2 billion carryout next year and would likely send December corn below $4.00. However, having only a 1.2 billion carryout could send December corn to $8.

This means the June 28th report will likely be the most important USDA report of the year.

Can Trendline Yield Still Happen?

Many market participants are saying a trendline yield is no longer possible; however, I think it is way too early to say that. Yes, some of the crop was planted a little slower than optimal, but currently only 5% of cropland is in a drought. That is 5% lower than two weeks ago, and 30% lower than this time last year. Timely July rains will be the key.

Statistical analysis suggests there is a 50% chance yields will be above or below a 2.5% drop from trendline, which would mean 176.4 per bushel yield. This comes from looking back at the past 30 years when the corn crop gets to at least 70% planted. So, at this point it could go either way. There could be timely rains in July and August, like in 2014, and a new record yield may happen. Or there could be widespread drought conditions which would drive the national yield much lower.

The following balance sheet for corn shows the current 90 million acres the USDA reported in March. I have added columns for 87 million and 93 million acres (in blue) as well as to project several different yield scenarios from current trendline to lower values (pink)

In the balance sheet, I am assuming there will be an increase in feed demand and exports by 100 million bushels total for the remainder of the 2023 marketing year (green).

If 90 million acres are planted, and there is a 2.5% drop in the trendline yield to 176.4 then corn futures are probably close to where they need to be right now.

However, if only 87 million acres get planted the upside potential in the market is really strong. Higher prices would likely lead to the rationing of demand (yellow). This means July rains will be critical to maintain adequate supply.

If there are significantly more than 90 million acres planted, then there is more room in the balance sheet for lower yields.

Bottomline

We won’t know how many corn acres were planted until 11 AM CST on June 28th. However, based upon conversations with farmers and the economics of growing corn around the country, I suspect more than 90 million corn acres will have been planted.

Jon Scheve

Superior Feed Ingredients, LLC

9358 Oak Ave

Waconia, MN 55387

Comments