Indian Crop, Put Options, Broilers & Ethanol, Markets & Rain Days Update 5/5/22

- Wright Team

- May 4, 2022

- 4 min read

Highlights

After Federal Reserve Chairman, Jerome Powell, announced the Fed was raising the interest rate a half percent (50 basis points) yesterday after, he later added the Fed was not "actively considering" a 75 basis-point rate hike next month or any month. The market was expecting a 75 basis point increase in May and June. Powell's comment sent the dollar lower, where it stayed the rest of the day and started that way in early Asia trading. At midnight, the dollar index was 102.51, down 66 points from last week's settlement. The sharply weaker dollar supported commodities, especially crude oil as did the news that the EU will continue to try to wean itself from Russian crude oil.

Russia’s ruble is trading at 68 rubles to the US dollar, the strongest exchange dollar for ruble since March of 2020. Before ruble was tied to a gold standard late March it took more than 120 rubles to buy a US dollar. Right there is the difference between a currency truly tied to a standard, in the case of the ruble, gold, and a currency whose value is determined by how many are printed. It is estimated that 40 to 60% of all the US dollars in circulation today were printed within the past two years.

India has harvested five consecutive record large wheat crops and it was looking like this year’s crop would be the 6th. Then hot weather hit in mid-March, two weeks after their three month long harvest began.

In early April, India’s government predicted this year’s crop would be 111.3 million mt. India was telling the world they had plenty of wheat to cover the shortage from Ukraine, but the extreme heat persisted into mid-April and private analysts began to reduce the size of the crop.

Rumors surfaced yesterday that India would curtail wheat exports after India’s government did, in fact, reduce their wheat production estimate to 105 million. July CBOT wheat was up 31 cents yesterday.

How desperate is the world wheat situation?

Two years ago, India harvested a record large 95.4 million mt of wheat.

Last year, India harvested a record large 102.22 million mt of wheat.

So, if India does harvest a lowly 105 million mt of wheat this year, it will be their sixth consecutive record wheat crop. India also said it will not curb wheat exports as there are plentiful supplies of wheat in the country. The 31 cent run-up in July CBOT wheat yesterday presented a selling futures and put buying opportunity. Don’t be spooked by the wheat market action; look at the facts.

Chinese markets reopened today after three days of celebrating May Day.

Gulf basis yesterday was stronger for soybeans and corn, with late August through new crop harvest corn bids being the strongest. Barge freight was mixed on the front end, but higher for new crop. That means a lot of export loadings are scheduled for late summer and harvest.

July soybeans have been really doggy the past two weeks and it is because of soymeal, which is down $50.30 since April 21st. A 50% retracement would take the meal back to $442.65, but when will the retracement (correction) start? Maybe today is the day.

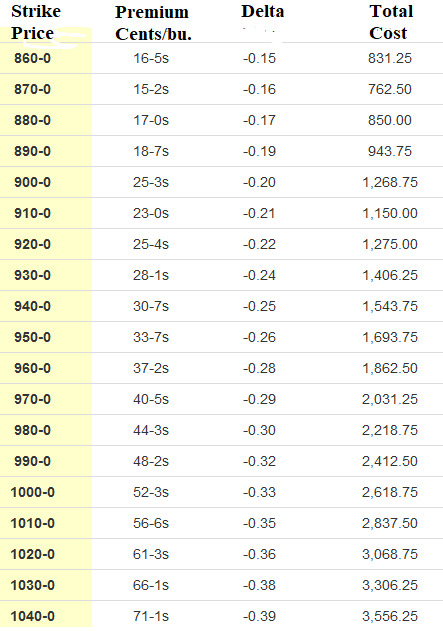

Wheat Put Discussion

Thursday morning for Market action on May 4th.

September wheat futures settled at $10.79¼ yesterday, up 29¾. All puts should have lost value since the futures price was sharply higher.

The $10 put lost 9¾ cents while the $9.00 put was unchanged 25 3/8 cents. A short futures short position lost $1,487.50, the $10 put lost $487.50 and the $9 put lost nothing. The wheat in the field or bin gained about $1,487.50, because cash price = futures plus basis. Note the $9.00 put is so far out of the money ($1.49) before yesterday’s trading began, what does another 29¾ cents make? Obviously not enough to change the price of the $9 put.

It is unusual for futures price to move 30 cents and an option value does not change, but it happens. There is not a direct correlation between futures price change and option price change. Yes, we have the delta, but that is a computer generated number as to what the price correlation should be between options and futures. But options are traded bid and ask, just like the futures and farm auctions. Sometimes, the auction price makes no sense.

Here are yesterday’s prices of the opinions we are following. The daily price changes make an interesting trail.

Broilers & Ethanol Update

Last week:

Broiler egg set was up 1% than the same week a year ago.

Broiler egg hatch was up 1% than the same week a year ago.

Average daily ethanol production:

969,000 barrels last week.

963,000 barrels the previous week.

952,000 barrels the same week a year ago.

598,000 barrels the same week two years ago.

Ethanol inventory was 23.887 million barrels compared to 23.965 million barrels the previous week.

Market Data

This morning:

Crude oil is at $108.74, up $0.93

The dollar index is at 102.63, up 0.04

July palm oil is at 6,816 MYR, down 288. The contract high was made April, 29th at 7,229 MYR. Palm oil owns 36% and soybean oil owns 28% world market share.

December cotton is at $129.25, down $0.53 per cwt. The contract high was made yesterday at $129.91 per cwt. Cotton competes with soybeans and corn for acres.

July natural gas is at $8.680, up 0.208. The contract high was made today at $8.708. Natural gas is the primary cost to manufacture nitrogen fertilizer.

July ULSD is at $3.9197 per gallon, up 0.0375. The contract high was made today at $3.9224. ULSD stands for Ultra Low Sulfur Diesel.

Rain Days Update

The Western Corn Belt has 1 more rain days in the 10 day forecast than yesterday and the Eastern Corn Belt has 1 more rain days than yesterday.

Comments